Exchange-Traded Funds are also known by their acronym, ETFs. ETF trading has emerged as a popular form of investment, offering investors exposure to diversified portfolios of assets. In this comprehensive guide, we’ll delve into what ETFs are, how they work, the different types available, their distinctions from other investment options, and the associated risks and rewards.

What Are ETFs?

ETFs are investment funds traded on stock exchanges, akin to individual stocks. They typically hold a basket of assets such as stocks, bonds, commodities, or a combination thereof. ETFs are designed to track the performance of a specific index, sector, or asset class. For example, a widely known ETF is the SPDR S&P 500 ETF (SPY). SPY mirrors the performance of the S&P 500 index.

How Do ETFs Work?

ETFs are created and managed by financial institutions known as ETF sponsors. These sponsors assemble a diversified portfolio of underlying assets that align with the ETF’s investment objective. They then issue shares of the ETF to investors in the secondary market. The price of these shares fluctuates throughout the trading day based on supply and demand, much like individual stocks. ETFs must be registered with the Securities and Exchange Commission.

One of the distinguishing features of ETFs is their creation and redemption mechanism, which helps maintain their market price close to the net asset value of the underlying assets. Authorized participants, typically large institutional investors, can create or redeem ETF shares directly with the ETF sponsor. By doing so, they help keep the ETF’s market price in line with the value of its underlying assets. Many stock trading programs also offer the chance for individuals to invest in ETFs.

Types of ETFs

1. Broad Market ETFs: Broad market ETFs are exchange-traded funds that seek to track the performance of a broad market index, such as the S&P 500, the Total Stock Market Index, or the Wilshire 5000. These ETFs aim to provide investors with exposure to a diversified portfolio of stocks representing a large portion of the overall stock market. Broad market ETFs typically hold a wide range of stocks across various sectors and market capitalizations, offering investors broad exposure to the equity market.

2. Passive ETFs: Passive ETFs, also known as index ETFs or index-tracking ETFs, are ETFs that passively track the performance of a specific index, such as a broad market index, sector index, or thematic index. These ETFs aim to replicate the returns of their underlying indexes by holding a portfolio of securities that closely mirrors the composition of the index. Passive ETFs do not actively select or manage individual securities; instead, they follow a rules-based approach to replicate the index’s performance.

3. Industry or Sector ETFs: Industry or sector ETFs are investment funds that provide exposure to ETF trading in specific industries or sectors of the economy such as technology, healthcare, or energy. These ETFs invest in companies that operate within a particular industry or sector, allowing investors to gain targeted exposure to areas of the market they believe have strong growth potential or are undervalued. Some of the most famous sector ETFs are oil (OIH), energy (LE), financial services (XLF), real estate (IYR), and biotechnology (BBH).

4. Bond ETFs: Bond ETFs provide exposure to a diversified portfolio of bonds. These ETFs invest in a variety of fixed-income securities, including government bonds, corporate bonds, municipal bonds, and mortgage-backed securities. Bond ETFs allow investors to gain exposure to the bond market without directly owning individual bonds.

5. Commodity ETFs: These provide exposure to commodities, which are raw materials or primary agricultural products that can be bought and sold. These ETFs typically invest in physical commodities, commodity futures contracts, or shares of companies involved in commodity-related industries. Some common commodity ETFs are gold (GLD), silver (SLV), crude oil (USO), or natural gas (UNG).

6. International ETFs: These invest in foreign markets, providing diversification beyond domestic stocks and bonds. These ETFs invest in a diverse range of international securities, including stocks, bonds, or a combination of both. Some stock trading programs allow investors to trade ETFs without fees. There are several types of international ETFs, including Broad Market International ETFs, Regional ETFs, Country-specific ETFs, and Sector-specific international ETFs.

7. Style ETFs: These track investment styles such as growth, value, or dividend-focused strategies–categorizing stocks based on their investment style or characteristics. Style ETFs typically follow a classification system that divides stocks into categories based on two main dimensions: size and investment philosophy. There are different combinations of size (large-cap, mid-cap, small-cap) and different types of investment philosophy (value, growth, blend). By investing in style ETFs, investors can implement different investment strategies and diversify their portfolios across various styles and market segments.

8. Leveraged ETFs: These ETFs aim to amplify the returns of an underlying index or asset class by using financial derivatives and debt. These ETFs use leverage to increase their exposure to the underlying assets. These are designed to amplify short-term returns and are generally not suitable for long-term investments due to the compounding effect of daily rebalancing and volatility in leveraged ETF trading.

How ETFs Differ from Other Investments

1. Mutual Funds: Mutual Funds are similar to ETFs in the fact that they both create an aggregated portfolio. However, mutual funds are priced once per day at market close, while ETFs trade on exchanges throughout the day at market prices. ETFs also tend to have lower expense ratios or management fees compared to mutual funds.

2. Closed-End Funds: Closed-end funds issue a fixed number of shares through an initial public offering (IPO) and are traded on exchanges like ETFs. However, unlike ETFs, closed-end funds do not create or redeem shares based on investor demand, which can lead to significant premiums or discounts to net asset value.

3. Individual Stocks: While ETF trading and individual stocks trading happen on exchanges, ETFs provide instant diversification by holding a diversified group of securities. This diversification can help reduce risk compared to investing in individual stocks.

4. Options: ETF options provide investors with the opportunity to hedge or speculate on the price movements of ETFs. They offer flexibility and leverage, but also carry additional risks such as time decay and volatility.

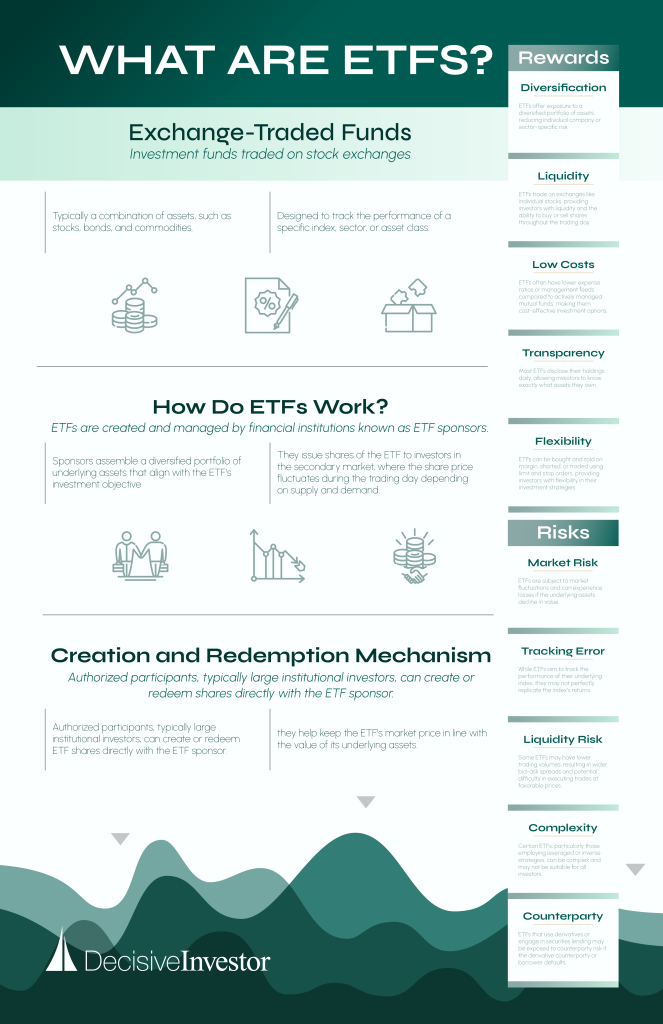

Risks and Rewards of ETFs

Rewards:

1. Diversification: ETFs offer exposure to a diversified portfolio of assets, reducing individual company or sector-specific risk.

2. Liquidity: ETFs trade on exchanges like individual stocks, providing investors with liquidity and the ability to buy or sell shares throughout the trading day.

3. Low Costs: ETFs often have lower expense ratios or management feeds compared to actively managed mutual funds, making them cost-effective investment options.

4. Transparency: Most ETFs disclose their holdings on a daily basis, allowing investors to know exactly what assets they own.

5. Flexibility: ETFs can be bought and sold on margin, shorted, or traded using limit and stop orders, providing investors with flexibility in their investment strategies.

Risks:

1. Market Risk: Like any investment, ETFs are subject to market fluctuations and can experience losses if the underlying assets decline in value. ETF trading holds the same risk that all types of investments carry.

2. Tracking Error: While ETFs aim to track the performance of their underlying index, they may not perfectly replicate the index’s returns due to factors such as fees, trading costs, and portfolio rebalancing.

3. Liquidity Risk: Some ETFs may have lower trading volumes, resulting in wider bid-ask spreads and potential difficulty in executing trades at favorable prices.

4. Complexity: Certain ETFs, particularly those employing leveraged or inverse strategies, can be complex and may not be suitable for all investors.

5. Counterparty Risk: ETFs that use derivatives or engage in securities lending may be exposed to counterparty risk if the derivative counterparty or borrower defaults.

Best Stock Trading Program for ETFs

Determining the best stock trading program for ETFs can depend on an investor’s specific needs, preferences, and investment objectives. However, one trading platform stands out for its robust features, user-friendly interfaces, and comprehensive ETF offerings. This platform is Decisive Investor, which works well with Fidelity. It has had great success over the past twelve and a half years, out-pacing the S&P 500 by 5.6%. Its multitude of supports and resources make it a popular choice for ETF investors seeking in-depth analysis, market insights, and financial success. Decisive Investor employs an advanced and one of the best stock trading softwares in the financial industry.

ETFs offer investors a versatile and cost-effective way to gain exposure to various asset classes and investment strategies. By understanding how ETFs work, the different types available, and the associated risks and rewards, investors can make informed decisions that align with their financial goals and risk tolerance.